Guarantee With Confidence: Discover Tailored Insurance Policy Services for Unparalleled Satisfaction

Are you searching for insurance coverage that is specifically created to meet your distinct demands? Look no more. With our customized insurance solutions, you can guarantee with confidence and take pleasure in unrivaled satisfaction. We recognize that everyone's way of life is various, which is why we offer individualized insurance coverage plans that fit your individual requirements. Discover the advantages of personalized coverage and locate the right insurance coverage carrier for you. Don't wait any longer - accomplish satisfaction with our detailed insurance policy solutions.

Understanding Your Insurance Needs

You require to recognize your insurance policy requires so that you can choose the right insurance coverage for your details situation. Insurance policy is not a one-size-fits-all remedy, and it's vital to examine your specific conditions prior to making any choices. Beginning by evaluating the dangers that you face in your specialist or personal life. Take into consideration elements such as your age, health, monetary circumstance, and line of work. Are you a homeowner? Do you own a car? Do you have dependents? When establishing your insurance policy needs., these are all essential inquiries to ask yourself.

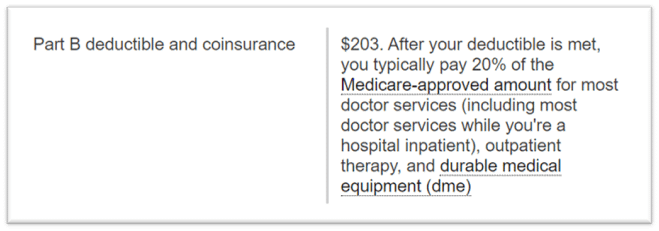

Finally, consider your spending plan. Insurance policy premiums can vary depending on the protection and the insurance policy service provider. It is necessary to discover an equilibrium in between the insurance coverage you need and what you can afford. Analyze your economic circumstance and determine just how much you're able and ready to invest on insurance coverage premiums. Bear in mind that while it is necessary to save money, it's similarly vital to have adequate coverage to protect on your own and your properties.

Tailoring Insurance Plan to Fit Your Way Of Life

When it involves fitting insurance plans to your lifestyle, we've obtained you covered. At our insurance provider, we understand that each individual has unique demands and choices. That's why we provide a variety of insurance policy alternatives that can be customized to fit your specific lifestyle - Home Insurance Eden Prairie. Whether you're a young expert beginning a household or a senior citizen appreciating your gold years, we have the perfect insurance coverage for you.

For the adventurous spirits who like to discover the open airs, we supply comprehensive protection for all your exterior activities. Whether you enjoy treking, winter sports, or even extreme sports, our insurance plan will certainly supply you with the satisfaction you need to totally appreciate your experiences.

If you're a home owner, we have insurance coverage that can shield your most useful possession. From protection for all-natural catastrophes to obligation protection, we'll make certain that you are well-prepared for any unanticipated situations.

For those who like a more relaxed lifestyle, we have insurance alternatives that cover all your requirements. Whether you're a collection agency of art or a red wine aficionado, we can offer you with specialized insurance coverage to shield your important belongings.

With our customized insurance coverage services, you can have unmatched tranquility of mind knowing that you are fully protected. Contact us today and let us help you locate the insurance plan that fits your way of life like a handwear cover.

The Benefits of Personalized Insurance Policy Insurance Coverage

Our customized insurance policy coverage uses various benefits to fit your one-of-a-kind way of living. Having a plan that is tailored to your details needs can make all the difference when it comes to safeguarding what matters most to you. With personalized protection, you can have comfort recognizing that you are protected in case of unforeseen conditions.

:max_bytes(150000):strip_icc()/Primary-Image-small-business-insurance-review-methodology-6979746-c6cae80d34bb4d89ae6d1df1be6f2bb3.jpg)

Among the major benefits of have a peek at this site individualized insurance policy protection is that it allows you to choose the protection choices that are most important to you. Whether you require insurance coverage for your home, cars and truck, or various other beneficial possessions, our customized plans can be personalized to fit your particular requirements. This indicates that you just spend for the insurance coverage that you in fact need, conserving you cash in the future.

One more benefit of individualized insurance protection is the adaptability it offers. Life is constantly changing, and your insurance policy needs may top article transform along with it.

In addition to these advantages, personalized insurance policy protection likewise supplies extraordinary client service. Our group of knowledgeable specialists is devoted to supplying you with the highest degree of solution and support - Auto Insurance Eden Prairie. We are below to address any kind of questions you might have, assist you with cases, and guarantee that you have the insurance coverage you need when you require it

Locating the Right Insurance Policy Service Provider for You

Locating the appropriate insurance coverage carrier can be a tough job, yet it's vital to make certain that you have the protection that fulfills your particular demands. With so lots of options available, it is necessary to make the effort to research and examine different insurance service providers before choosing. Start by considering what kind of insurance coverage you call for. Do you need auto insurance, home insurance, or maybe both? Start comparing the different providers in your location when you have actually recognized your requirements. Search for business with a solid credibility and favorable customer testimonials. It's also a great concept to get to out to pals and household for recommendations. As you limit your choices, pay focus to the degree of customer care each carrier uses. A trusted insurance supplier should be responsive, helpful, and easily obtainable. Don't forget to consider the cost of premiums and deductibles also. While it is necessary to locate a carrier that offers budget friendly prices, remember that the most affordable option might not constantly give the sites finest coverage. By taking the time to find the appropriate insurance coverage provider for you, you can have tranquility of mind understanding that you are adequately shielded.

Getting Peace of Mind Through Comprehensive Insurance Coverage Solutions

Having comprehensive insurance policy protection can give you a feeling of safety and protection. When unexpected events occur, such as accidents, all-natural catastrophes, or burglary, having the appropriate insurance policy can help minimize the economic burden and offer comfort. With detailed insurance coverage solutions, you can rest very easy knowing that you are financially shielded against a vast variety of risks.

One of the main benefits of extensive insurance is its capability to customize insurance coverage to your specific needs. Insurance companies provide various degrees of insurance coverage, enabling you to select the one that fits your lifestyle and budget. By functioning very closely with an insurance coverage expert, you can customize your policy to consist of the specific protections that matter most to you.

Verdict

With customized insurance policy services that fit your lifestyle, you can appreciate unequaled peace of mind. Do not settle for generic insurance coverage - discover an insurance coverage carrier that comprehends your special demands and offers thorough options.

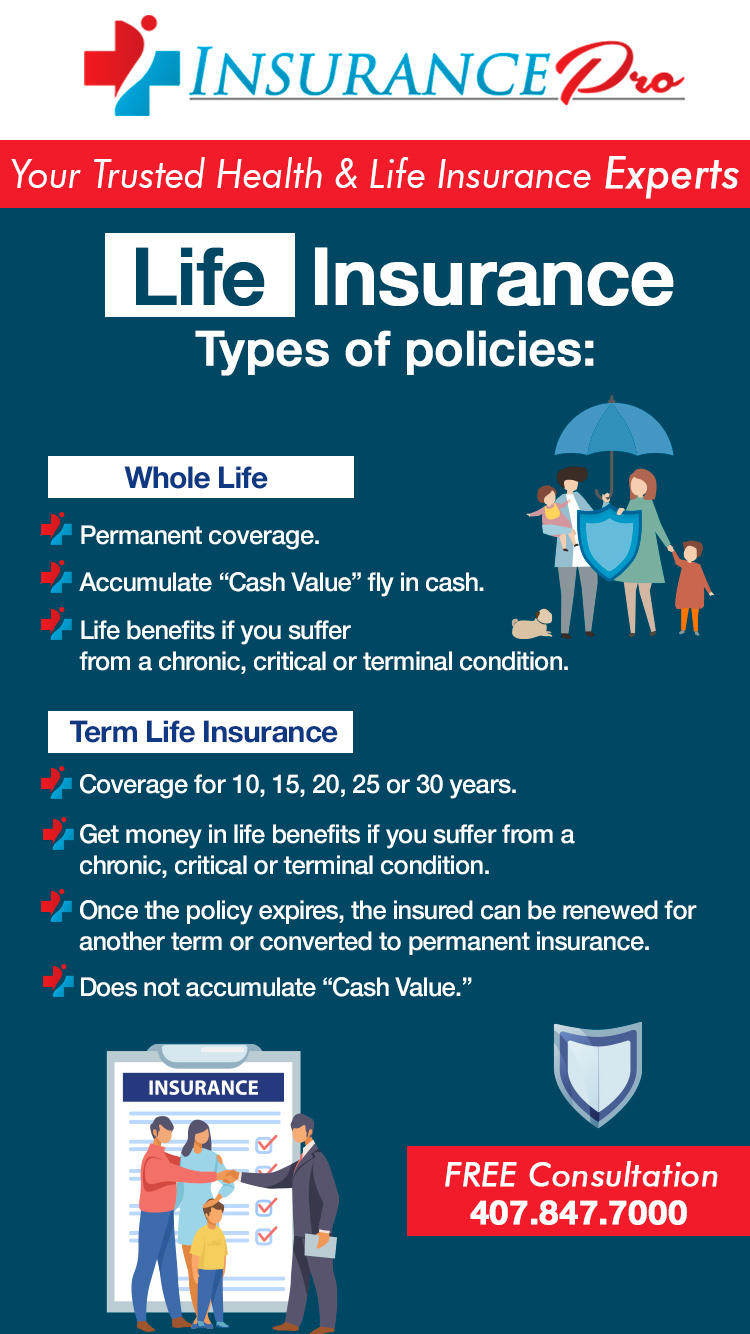

You require to comprehend your insurance coverage requires so that you can choose the right insurance coverage for your specific circumstance. There are numerous types of insurance coverage plans, such as health, life, home, automobile, and business insurance policy. Insurance coverage premiums can vary depending on the insurance and the coverage provider.One of the primary benefits of customized insurance policy coverage is that it permits you to pick the protection choices that are most essential to you. Do you need auto insurance coverage, home insurance coverage, or maybe both?